Profitable

Easy and fast solutions at your fingertips. Apply from anywhere, with just one document required

Easy and fast solutions at your fingertips. Apply from anywhere, with just one document required

Rely on our direct lending for security and innovation. Your data is protected, and we offer solutions when you need them

Easy and quick solutions without leaving home. Money is instantly transferred, with loan extension options

Send in your loan application using our app by filling out a quick form.

Allow 15 minutes for our decision-making process.

Obtain your funds, usually taking only one minute to transfer.

Send in your loan application using our app by filling out a quick form.

Download loan app

As a resident of Nigeria, you may be familiar with the challenges of obtaining traditional bank loans. However, with the rise of online lending platforms, the process has become more convenient and accessible than ever before. One of the key players in this industry is the 5 minute online loan, which offers a quick and efficient solution to your financial needs.

Unlike traditional bank loans that may take weeks to process, online loans can be approved and disbursed within minutes. This means that you can access the funds you need in a timely manner, without having to wait for extended periods of time.

With the click of a button, you can apply for a loan from the comfort of your own home or on the go, making it a convenient option for individuals with busy schedules.

Online loans offer a level of flexibility that is unmatched by traditional financial institutions. Whether you need funds for a medical emergency, unexpected bills, or any other urgent expense, online lenders are able to cater to your specific needs quickly and efficiently.

The application process is simple and straightforward, with minimal documentation required. This makes online loans accessible to a wide range of individuals, including those with limited credit history or no collateral.

Despite the convenience and speed of online loans, many borrowers are concerned about the cost of borrowing. However, online lenders in Nigeria offer competitive interest rates that are often lower than those of traditional banks. This means that you can access the funds you need without breaking the bank.

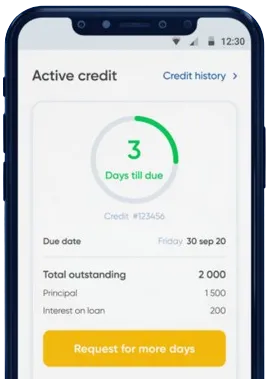

Repaying your online loan is also a hassle-free process, thanks to the various payment options available. Whether you prefer to make repayments via bank transfer, mobile money, or debit card, online lenders offer multiple channels to accommodate your preferences.

Additionally, some online lending platforms provide flexible repayment schedules, allowing you to choose a repayment plan that aligns with your financial situation.

In conclusion, 5 minute online loan in Nigeria offer a range of benefits that make them a valuable financial resource for individuals in need of quick and convenient access to funds. From convenience and speed to competitive interest rates and flexible repayment options, online loans provide a reliable solution to your financial needs in just minutes.

A 5 minute online loan is a quick and convenient way to obtain a loan through an online application process that takes just 5 minutes to complete.

Yes, you can easily apply for a 5 minute online loan in Nigeria from the comfort of your home or office using your smartphone or computer.

Typically, you will need to be a Nigerian citizen or resident, have a valid identification document, be at least 18 years old, have a source of income, and have an active bank account.

Approval times may vary depending on the lender, but many online loan providers in Nigeria can approve your loan application within minutes after you submit it.

The loan amount you can borrow with a 5 minute online loan in Nigeria varies depending on the lender, but typically ranges from ₦10,000 to ₦500,000.

The repayment period for a 5 minute online loan in Nigeria is usually between 1 and 12 months, depending on the terms and conditions of the lender you choose.